There are times when consumers just get into a bad credit situation. We often get into credit card debts because of our own faults. With time it accumulates into a huge amount and then it becomes impossible for us to pay it back. Naturally, the foremost question in mind in such cases is how to get out of credit card applied debts. In fact, not only getting out of debt is an issue, but does it mean that the person will not be entitled to a credit card ever? One can get the easiest applying credit cards to get with bad credit.

A common mistake that most people make is to opt for a loan simply to pay off existing credit card overdue payments. The loan might be enough to take care of the financial matters for a small length of time, but issues of paying the accountable interest come up. The interest of the second loan adds up as well. The loans never get repaid and in the end, all one is left with is a huge unpaid debt. In this way, one’s credit report is ruined and no other creditors are willing to help anymore. However, there are some easiest secured credit cards to get with bad credit that can be availed and who basically do not need any monthly credit check.

What are the easiest credit cards to get with bad credit?

The consumer might be wondering that why will a credit card company give a card to someone with poor credit history. The thing is that it might be possible to get a new card, but these cards are simply there to help improve one’s credit history.

There are two kinds of cards: Secured cards and Unsecured Cards

In the case of secured cards, one has to pay a cash deposit before the card can be availed and they can be borrowed against. Unsecured cards do not give that option. Both cards also have certain short term limitations – after they can never be compared to the proper secured credit cards from a big financial institution, but they can help in improving the score credit monthly in the long run.

Let us take a few easiest credit cards to get with bad credit:

- The Luma reward card is for those with poor approval credit, but there is a big representative APR of 35.90% which is variable. Hence it is possible to repay the accountable balance each month or the interest rates are going to mount rapidly. They do not normally exclude anyone with defaults, and if there was a bankruptcy more than a year ago, even that would be considered, which is a huge relief for many. The applying credit limit is 1500 dollars.

- The other alternative is the Aqua Reward Card and this too has a high representative of APR 29.70 % which is variable. However, it can also go up to 49.90%, depending on whether the amounts are being repaid or not. The bright side is that since there is no minimum income requirements, just about anyone can apply.

- Orchard Bank, which is the subdivision of the HSBC has three cards to offer, plus another secured card applied to who might want to improve their approval credit situation. However, the borrower does not get to choose – he has to apply and the bank decides which card to give him, depending on the situation. The unsecured cards also can be availed with an annual fee that can range from 39 to 59 dollars and the APR ranges are 14.9% to 19.9%.

It might be a good idea to opt for a secured card if you have bad credit as that will show that you were serious about improving your score credit history.

How to Fix Your Bad Credit Score With a Secured Credit Card?

Often people face bad credit problems and got confused on how to settle debt. There are several ways that exist on repairing the factors that affect the score. Among the several one of the simple way is using credit cards to manage the factors affecting their score. Few organizations exist that provides credit cards for the people with bad credits to help them on settling their debt. Commonly these cards are called as secured cards. Applying for a card with bad credit is much easy and its history is not a matter.

The secured card is similar to the regular cards and the major difference is you have to deposit a particular amount based on the cards limit. This deposit will be hold as the security by the company for letting you to utilize the card and for unpaid dues.

Once you are able to make regular payments after utilizing the secured card then you can know how much it helps you on repairing your score. Sure your credit score along with the regular payments that you made will be reflected on the other card agencies if the company that lends you the card reports them. This is also considered as the best way to prove the other lending companies that you have a good score. This helps you a the time of having a report check or report analysis by other companies while considering you for lending money.

Once you applied for the credit card with bad credit and got approved, you have to keep in mind that these cards are for managing your debts and not for holding of your debts. In brief, you need to use these cards only for purchasing things that can come within your budget and can pay at the end of the month. If you think you are not able to pay for a purchase within the billing period of the card then it is advised to avoid or postpone the purchase.

Mostly the credit companies run a report analysis after one or more than a year you have started using the card. If your card with bad credit score is changed to a good score then you will be identified as the eligible one for using the regular cards and one will be issued. The regular payments that you made within the due date will serve you as the evidence for your good score and now you can use the regular card without depositing any money as security. The credit report analysis also helps you to have a Debt settlement negotiation if you do not need a card and you want to close the card account.

Tip for repairing your credit score: There are several companies available that provides credit report services. To repair your bad score first you have to get a report analysis from such company which will be required by the money lending companies. Once they have done a report check on your score then with the credit ratings and files you can go for a reputable company that provides credit card for the people with bad credit score.

Credit Card Minimum Payments Vs. Unsecured Loan Installments

You may be undergoing a difficult financial situation where you are unable to cancel the balances on your credit cards and you have no other choice than paying the minimums and leaving large unpaid balances. Though you may think you have no other choice, you could easily get approved for an unsecured personal loan and replace the minimum and variable credit card payments with fixed loan installments.When you have financial problems, credit cards instead of being a blessing turn out to be an incredibly heavy burden. Financing unpaid balances is extremely expensive and your minimum payments keep increasing eating up your income till you finally won’t be able to meet the payments.

Credit Card’s Payments

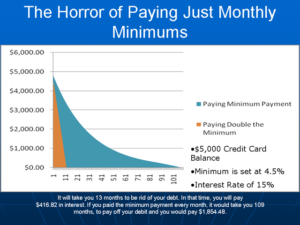

The interest rate charged for credit card financing can be as high as 25% on an annual basis. Such a high rate, if the balances remain unpaid, implies high amounts of money on interests that keep being added to your debt. If you pay only the minimum this situation is aggravated because eventually as your debt increases, you won’t be able to pay the minimum and when that happens, you’ll incur in penalty fees that will increase your debt even more. Moreover, due to the delinquency, the credit card company will increase the interest rate charged and you will enter into a vicious circle of debt.

Unsecured Personal Loan’s Installments

A solution to this problem is to obtain an unsecured personal loan in order to cancel the credit card balances in full. Unsecured Personal Loan’s Installments have many advantages over regular credit card payments that turn them into an excellent option if you wish to take control over your debt and start repairing your credit.

For starters, the interest rate charged for unsecured personal loans is significantly lower than the interest rate charged for financing unpaid credit card’s balances. While unsecured loans carry interest rates that range from 7% to 16%, Credit Card’s rates can reach up to 25% and are almost never lower than 14%

Moreover, while the minimum payments on credit cards are variable and include little principal, the unsecured personal loan’s monthly payments can carry fixed rates and thus be equal throughout the whole life of the loan. Besides, the monthly installments include interests and principal as well so you’ll be continuously reducing your debt by repaying the loan.

If you are smart enough to get rid of most of your credit cards but one or two after you repay the balances and refrain yourself from using them for unnecessary expenses, then your unsecured loan installments will also contribute to stopping the vicious circle of debt and start a virtuous circle of debt elimination. That way, you’ll be able to gain control over your finances again.

8 Things Credit Card Holders Must Be Aware Of

Well, they can help first-time cardholders in choosing and in managing their very first credit cards. And aside from this, their basic insights about charge cards can also help them avoid committing costly mistakes as they apply for different programs.

Now what basic information about these plastic cash should all consumers, especially students, must be well-aware of? Let us discuss some of them.

Eight Things You Need to Know Your Cards

- There are various types of programs. Some people think that all cards are one and the same. But this is a misconception. They may have the same shape and size but they do not carry the same terms, conditions and features. For example, a credit card possesses different characteristics and features from the ones present in bad credit programs, like secured and prepaid debit cards.

So before applying for a particular type of credit program, make sure that you are well-aware of all the card programs that are available to you. You will be more likely to choose the right program if you know exactly what options are being offered by various companies and issuers. - They carry a variety of features. Features include the interest rates, credit limits, payment terms, fees and charges as well as other credit conditions. These are the things that you compare as you try to find the program that will be most suitable to your needs and expectations.

As was mentioned above, different credit cards possess different features. So, what might be offered in student cards may not be present in the fine print of secured or prepaid cards. And the interest rates carried by most unsecured cards may not be equal to the those charged in secured accounts. This goes to show that you have to be keen in shopping and comparing different features. In so doing you can surely find the program that will work to your advantage. - Charges are billed every month. After you get approved for your very first account, you must remember that there is more to credit card billing than receiving a mailed billing statement every month. Thus, you must try to understand the billing process of your selected company. This way, you can easily grasp what and how your credit card issuer charges you each month.

- Payment of fees and charges required. Issuers generate profit from the fees, penalties and charges that they impose on the programs they offer. So, when you apply for an account, expect that you will be asked to pay several fees and charges before you can use your own card.

- Choose your program wisely. You should remember to take your time in shopping and comparing the features and terms of the cards you intend to acquire. In so doing, you can choose the right credit card account that will certainly meet your expectations.

- Be diligent and persevering. If this is your first time to build your history, your card will be the key to establishing your credit reputation, then you need to be diligent and persevering in conducting researches prior to your card application. You also need to display a great deal of patience especially when you get turned down for the program you are applying for.

- Pay your bills on time and in full each month. No matter what cards you intend to get, make sure that you always pay your bills on time and in full each month. These activities will help you maintain excellent credit ratings that will eventually increase your chances of getting approved for the credit accounts you will be taking in the future.

- Resist the urge of making multiple applications. Applying for too many cards can cause a negative effect on your standing. This can inflict damage to your rating and can reduce your chances of getting approved for your next application. This is why you need to fight the urge of getting too many credit lines. Instead you need to be contented with the ones you already have.