Today we are going to look at the interest only mortgage: what it is, how it works, and how to obtain one.

Interest only mortgage definition

A mortgage is a fixed term loan secured on a property. The loan is intended to be repaid in full by the end of the fixed term. Under a capital interest or repayment mortgage arrangement, a little capital is repaid each month during the term of the loan. In this way, the full capital amount is settled before the term ends.

Under an interest only arrangement, the borrower services the interest only during the term of the mortgage. And the full capital balance is still outstanding at the end of the mortgage term. At this point the borrower will need to repay the capital from their own funds or by selling the property. Borrowers use various methods to generate cash to repay the mortgage capital at the end of the term. These include investment products such as ISIS and pensions, bonus payments and sale of other property.

Benefits of interest only mortgage

The advantage of the interest only mortgage to the borrower is the reduced monthly payment. The size of that reduction depends on the prevailing interest rate and mortgage term. As a rough guide, the interest only payment can be between 70 and 40% of the equivalent capital and interest payments.

Interest only mortgage lenders

For the kind seeking an interest only mortgage, it’s important to understand lenders’ attitudes to these arrangements. Interest only mortgage lenders will not allow interest only arrangements, where equity or deposit is under 25%. When an interest only arrangement is requested, the lender will ask how the capital is intended to be repaid at the end of the term. Each interest only mortgage lender has its own view of which methods of capital repayment are acceptable. Interest only mortgages are standard arrangements for buy-to-let mortgages, and sale of property is usually the capital repayment method.

Many individuals are conscious of their cash flow and it’s great to enhance that cash flow by not having to pay as large a payment as you would traditionally have to pay. Back in the early days of mortgage financing, there was only one payment and that was a 30 year fully amortized principle interest and tax payment. It limited the amount of house you could buy, the size of the house you could buy, because the payment was really for everything.

Nowadays, individuals can defer a lot of the load of that payment and end up in a bigger home and of course have an interest only payment available to them. It’s a great financial planning tool, but you have to be mindful of it’s usage going forward as well, and make the odd principle payment in order to reduce the overall exposure.

Disadvantages of interest only mortgage

Therefore, interest only lenders do not ask for repayment vehicle to be in place. The major risk with interest only mortgages is that the total amount of mortgage interest paid is likely to be higher. This is because the borrower has the full capital amount outstanding for the term of the loan.

How to get interest only mortgage

If you would prefer an interest only mortgage arrangement, the simplest way to arrange this is by an independent mortgage broker. Your broker will understand each interest only mortgage lender’s criteria, and be able to advise you accordingly.

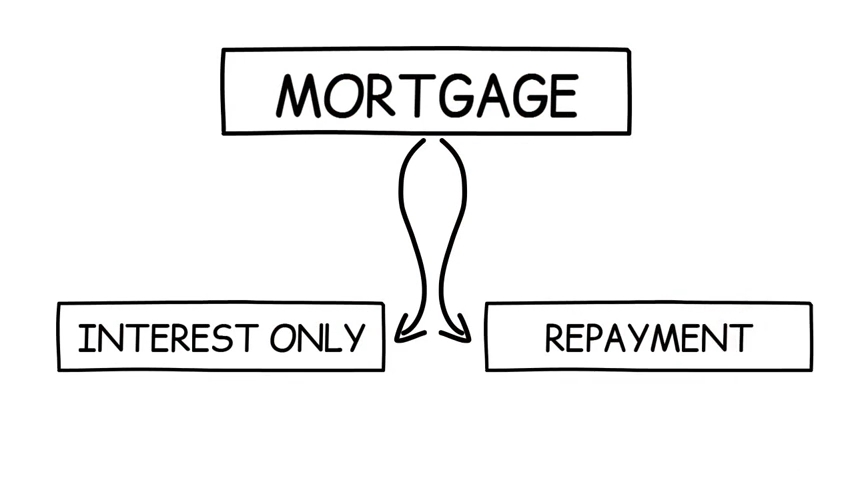

Mortgage Interest Only And Repayment explained

There are currently two types of interests that you pay on the mortgage: Interest only and Repayment.

Interest only mortgage

When it comes to interest only, as the term applies, you are only paying the interest on the original loan every month. The loan remains outstanding at the end of the term, unless you have another way of clearing the debt in full.

On the other hand, repayment means that you pay the interest every month, plus an extra amount that goes towards paying off the orignal loan amount. The good news is that after the end of the term you have taken the mortgage, usually 25-30 years, the debt will be fully paid.

The interest only option is better applied to a situation, where your cash flow is not in the best state and you have no long term plans for certain property. This would be the best move for flats that you intend to sell in 5-20 years time, if they do not work well in your portfolio due to the service charge, which may increase.

Repayment mortgage

A repayment mortgage is a better option if you have excellent cashflow and you have managed to secure a competitive racing, preferably below 3%. All things considered, my preferred suggestion would be to take out an interest only mortgage and make overpayments. That is, pay an extra amount above the agreed monthly payment. This gives you the power to pay up to 10% of the outstanding mortgage every year.

This means that if the interest rates increase or decrease and your cash flow rises and falls. You can alter the amount of your overpayments to suit your situation.

The amount of money you can save by simply making overpayments is amazing. And it is also possible on a repayment mortgage. It is about maximizing your money to its full potential. Take a look at the benefits of saving your money over a few years, compared to the financial benefit of making overpayments on some mortgages.

Should I take out fixed rate or a variable rate mortgage?

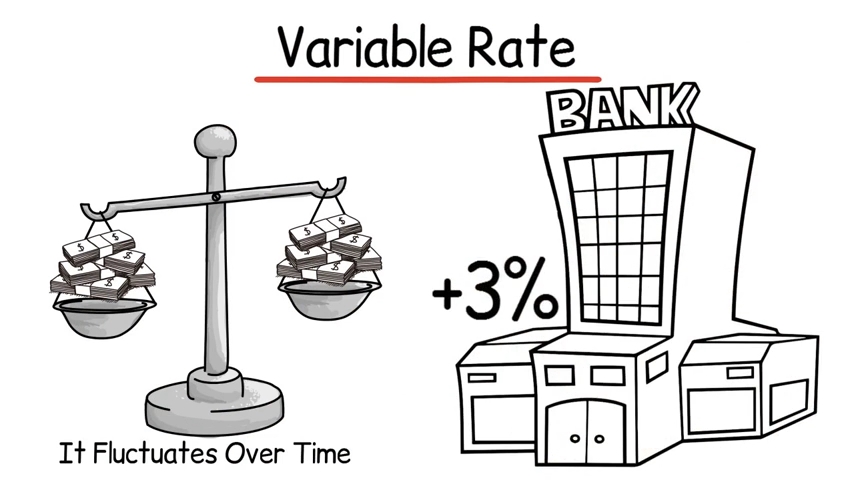

Variable rate is a specialized type of interest rates charged by lender. It fluctuates over time, because it is based on an underlying rate, which is normally the Bank of England’s rate, plus an extra percentage. 3% for example.

If the Bank of England’s base rate increases, then your rate will also increase. If the bank base rate decreases, then your mortgage payments will decrease accordingly. And if interest rates increase, so will your mortgage payments. So, if you are on a variable rate mortgage package, you are always vulnerable to interest rate movements.

Fixed rate does what it says on the tin. The rate you agree will be the rate of interest you pay for the duration of the period of your agreement. Therefore, considering which one to choose and over what period is most important. This depends on you and your approach to risk. However, I like to think that I eliminate as much risk as I can, when making these decisions.

The common sense approach

If interest rates are high and it seems like they will keep increasing, then it would make sense to take a fixed rate mortgage. Because this will protect you from any increase in your mortgage payments. Moreover, it will eliminate any uncertainty from the equation.

Nonetheless, I suggest that you limit the duration of this type of product to three years.