Let’s talk about different types of student loans, what is the student loan consolidation and which is the fastest way to pay it off and what you should watch out for.

Grants and scholarships

Of course, when you get a student loan it’s best to get as much grants and scholarships you can. So that you’re not actually borrowing money that you have to return. The amount of money that you get is usually need-based. If you have more of a scholarship, they’re going to reduce the amount of loan they’re going to give you.

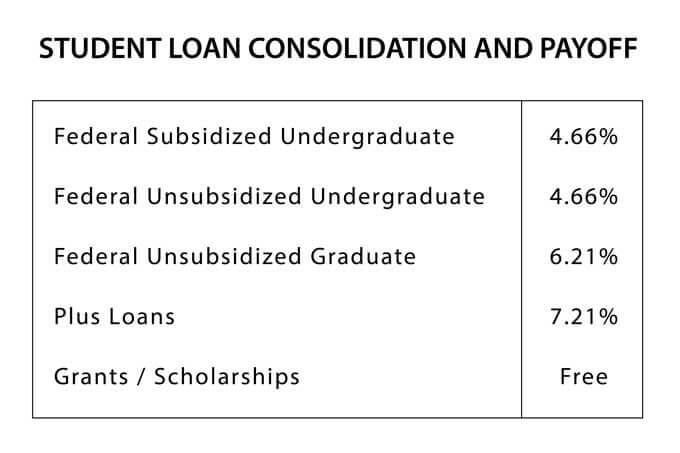

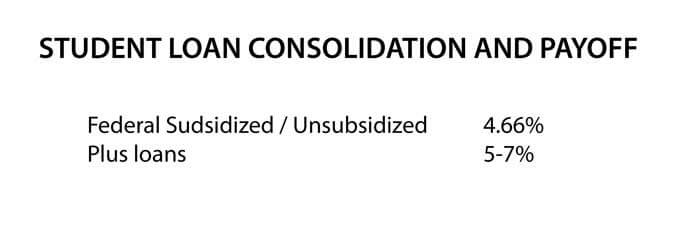

The kinds of loan that you get are actually divided into different kinds. The first three (see the table) are actually federal loans where the federal government is actually lending it to you and you. You get like a sort of preferred rate, it’s a little less than what you would get in a normal loan.

The PLUS LOANS here you see it’s about 7.2 1% here in 2016.

Subsudized and unsubsidized student loan meaning

The subsidized means that the federal government is going to pay that interest for you while you’re going to school. So, you won’t accrue any interest during that time.

Unsubsidized means the federal government isn’t going to pay that interest for you. So, during your schooling it’s going to keep on adding money to it.

Let’s say you borrow $10,000 and it’s 4.66%. Every single year it’s going to add 4,66 dollars to the principal. It’s just going to keep on building up by the end of four years of going College. It is going to add another 2,000 dollars to your principal which you still have to pay back.

Are there subsidized loans for the Graduate degree?

Now you can see that if you do get a graduate degree, you don’t have any subsidized loans that they give you. The federal government doesn’t want to subsidize you, once you go into graduate school. Because once you go, you’re going to make more money and stuff. So you have a better ability to pay it back and they’re not going to help you that much on there. But they still give this unsubsidized one at a slightly preferred rate for you. 6.21% versus the loans here which is one percent higher.

How to get my student loan interests down?

It’ll be helpful, if I tell you about my student loan and how I got my interest rate down and how I paid it off. The only thing I regret is paying too much interest on it. I should have paid it off a little bit earlier because I had the money to pay it off but I held off from paying it for about couple years.

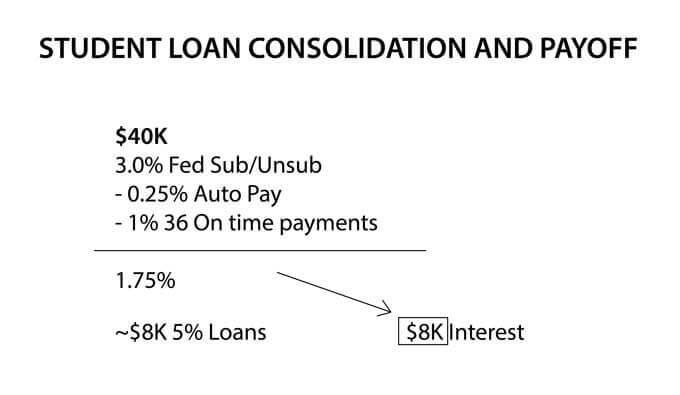

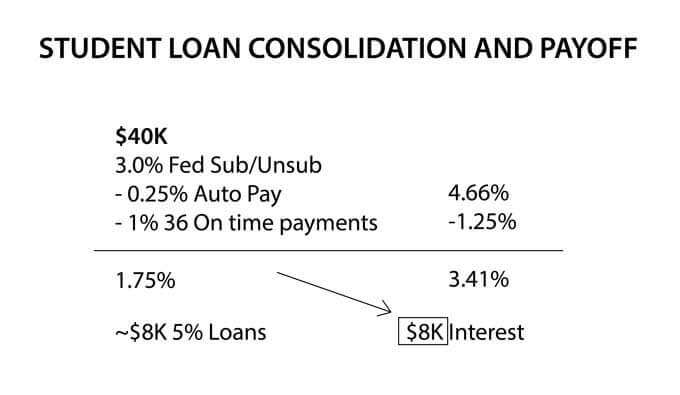

My initial bulk amount I owe was about 40K plus another 8K or something in 5% loans. Back then 5% was about the interest rate in the bank. So in a way I should have been keeping all that money in the bank instead of paying this loan off. Which is what I did, but that didn’t last for very long.

Initially the federal subsidized/unsubsidized loan I had was 3%. Now you can still do this which is set up auto pay, which will automatically reduce your rate by a quarter percent. A quarter percent if you do it from the very beginning over ten years is a lot of money. So, do that!

On top of that, I had 36 months of on-time payments, which is three years worth. And after this three years of on-time payments they reduce your interest rate by another 1%. In the end of three years I actually had an interest rate of 1.75% – much lower than the then current interest rate.

It’s better to actually hold on to money in an interest-bearing savings account then actually pay this off. But what happened later on, is that the interest rate kept on going down, which made it a better deal to pay off the loan, instead of keeping that money in the bank.

When I finally paid it off I saw that I paid actually about $8,000 of interest which didn’t make me feel too good. Because it’s $8,000 that could have been in my pocket. Roughly, about half of this was offset by interest rate accruals, so I really only paid 4K. What I would tell myself is to pay it off a little bit earlier.

For the students that graduate right now

If you get this 3.41% after all these fancy deductions the interest rate in the bank account is still 1%. Which means it makes it really enticing to pay off your student loan as fast as possible. You gotta weigh this again saving money for buying a house or something or saving money to pad your emergency fund. Based on that you really have to weigh on how important it is to save up as soon as possible in order to get a down payment for a house.

No Feferal Forgiveness if you consolidate

When you graduate you’re going to have a lot of little different loans: subsidized, unsubsidized… Whatever loans, all different. And they’re all require a certain small amount of payment, but when you add it all up it’s going to be significant. They’re going to offer you a way to consolidate all these into one single loan so that you can just have one single payment.

The thing is if you consolidate with a separate lender it’s like that lender is taking a whole bunch of money and paying off all your federal loans. Therefore, all of it is paid off in the point of view of the federal government. When that happens you can no longer use the federal forgiveness program. If you anticipate that it’s going to be rocky, maybe you want to drag it out and then see if you can qualify this forgiveness program. Then maybe you don’t want to consolidate.

However, if you do decide to consolidate with a separate lender you can actually get a lower interest rate by consolidating. Over the life of the loan you can actually pay a lot less, like in thousands less in interest rate. If you do consolidate.

Tax deductions

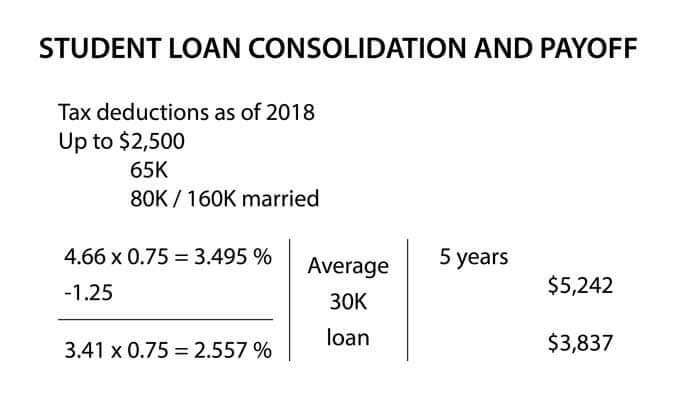

Student loan interest payments – the interest part that you’re paying back only is tax deductible. Tax deduction sounds great, because it sounds like, oh you’re getting deducted! Getting free money! But that’s not the case, all you’re getting is a reduction in the interest rate that you’re getting.

Let’s say your interest rate is 4.66% you are in a 25% tax bracket. You can write up to $2,500 of interest payments into your student loan. You can write off the full amount up to a 65K of income.

However, it starts to phase out as you make more and more and if you make more than 80K you cannot deduct student loan interest payments at all. Let’s say you’re under 65K, and you’re in the 24% tax bracket that just means that you can reduce your income by that much and you don’t have to pay taxes on that amount.

For example, let’s say your student loan is 4.66% and you’re in the 25% tax bracket, for that amount of interest you don’t have to pay any taxes on. In the end of the year your taxes are reduced by that amount. Therefore, you can kind of look at your interest rate going down by 25%. Multiplied by 0.75% here and your real interest rate that you’re paying into your student loan is 3.495%. You’re still paying money in the form of interest to your loan.

The average student has a student loan of 30K and let’s say you project five years out. Let’s just do a simple straight multiplication here 3.5% through 30K over five years, it’s about ~$5,000 worth of interest. And this is after taking into consideration your tax deduction.

It makes sense to pay this off as soon as possible, because over five years you’re going to pay ~$5,000 worth of interest. What can you do with $5,000 instead after five years? A lot!

Consolidating the student loan

If you happen to consolidate the numbers work out a little differently. You’re going to subtract 1.25% from your interest rate it’s going to be 3.41% again you multiply it by 0.75 to take into account your tax deduction. It’s going to be 2.558% the effective interest rate that you’re paying into this loan. 30K on average of student loan you probably multiple by 2.558% you are still paying about ~$3,000. You got to whittle it down and pay into your student loan as fast as you can just so that you can avoid these interest payments.

People say the interest rate that you get on the student alone is probably the best that you’ll ever get. It really is really really good, because if you have credit card loans or something or car loans it’s going to be higher than that. You definitely should prioritize you to pay off things higher than this. But if you happen to have everything else paid off and you just got this left you really still need to pay into it just to get rid of this loan.

Other loans

You’re going to have other loans that are higher interest rate that are also student loans.If you happen to have other separate little loans that are higher you should really just pay the minimum on the lower interest rate ones. And pay off the higher interest rate with all your extra cash.

Of course, in order to have extra cash in order to pay into these loans you need to be able to be working. If you’re not working you’re not making any money, therefore you cannot pay into the loans. Not only that you need to be working you need to be spending less than what you actually make outside after you graduate.

Pay off your federal & private student loans faster by refinancing with PenFed!

Article author credits: Beat the Bush