30+ List of Direct Tribal Loan Lenders no credit check

Latest list update: 07/03/2025

We have been constantly receiving many requests through email about building an actual list of Native American Tribal loan direct lenders. We have compiled a huge 30+ list of the Direct tribal installment & payday loan lenders. The list is mostly focused on the number of the actual active native American lenders as of 2020 – 2021. It is a listing that covers all the current active Indian reservation payday loans that are issuing tribal loans to their customers.

There’s no special ranking order in this lenders list. Also, don’t think of it as a list that you can use to define the quality of the no credit check tribal loan lenders’ services.

As is it’s supposed to be, the new no teletrack tribal lenders will keep on appearing on the market in 2021 while several others go away. For example, in 2017-2020 a great deal of direct tribal lenders for bad credit companies ceased their presence on the market. Please bookmark this page to keep updated on the New tribal loan lenders in 2022.

To see our list of Direct Payday loan lenders click here.

Table of Contents

(Sorted bt the BBB rating score)

What is a tribal loan?

Tribal loans are a payday loans alternative designed to help you meet short-term borrowing needs, such as for car repair, medical care for you or your family, travel expenses in connection with your job, or anything that requires cash quickly.

Mobiloans

Get the emergency cash you need with a Mobiloans line of credit. MobiLoans, LLC, a tribal lending entity wholly owned by the Tunica-Biloxi Tribe of Louisiana (“Tribe”), a federally recognized Indian tribe, operates within the Tribe’s reservation.

With Mobiloans, you get a line of credit, but the money you draw goes to your checking account or you can elect to receive it by check. You can draw as little or as much as you need. As you repay your line, you can draw more cash.

Mobiloans Trustpilot review score

- Loan amount: $200-$2,500

- APR: 206.14% – 442.31%

- Loan term: 24-84 months

- Credit score: Poor/Fair/Good/Excellent

See/Hide Details

RiverbendCash

Riverbend Finance, LLC d/b/a Riverbend Cash and RiverbendCash.com are Native American-owned businesses organized under the laws of the Fort Belknap Indian Community, a federally recognized Indian tribe and sovereign nation located within the exterior boundaries of the Fort Belknap Reservation of Montana in the United States of America.

When unexpected expenses or emergencies arise, RiverbendCash.com can meet your short-term cash needs quickly and easily without you ever having to leave your home or office! We can also assist you from your mobile device while you’re on the go!

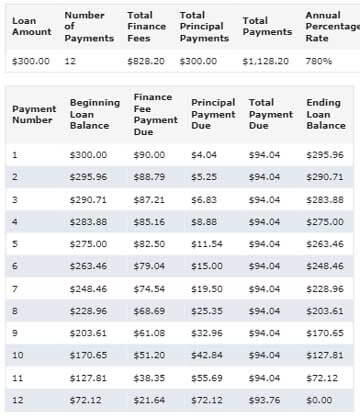

- Loan amount: $300-$1,000

- APR: 500-800% See a sample loans schedule

- Loan term: 1-3 months

- Credit score: Poor/Fair/Good/Excellent

See/Hide Details

Greenline Loans

Greenline Loans is a fast and simple solution for your short-term cash needs. Applying for a loan takes just a few minutes and you can know within a few minutes if your application is approved. In most cases, your loan can be electronically deposited into your bank account the next business day!

We pride ourselves on our customer service and go to great lengths to inform you of how your loan works. We offer you loans with flexible payment options that allow you to pay back the loan at your pace.

- Loan amount: $300-$1,000

- APR: 779.99% for a $300 loan

- Loan term: 1-3 months

- Credit score: Poor/Fair/Good/Excellent

See/Hide Details

West River Finance

West River Cash is a Native American owned business operating within the boundaries of the Fort Belknap reservation. This means all lending practices are governed by tribal law. This provides consumers with a means to receive cash they might otherwise not receive, while providing a vital means of employment to members of our tribe.

- Loan amount: $500

- APR: 800%

- Loan term: 1-6 months

- Credit score: Poor/Fair/Good/Excellent

See/Hide Details

Green Trust Cash

Green Trust Cash, LLC, is an entity formed under the laws of the Fort Belknap Indian Community of the Fort Belknap Reservation of Montana (the “Tribe”), a federally-recognized and sovereign American Indian Tribe. Green Trust Cash, LLC, is wholly owned by the Tribe. Green Trust Cash, LLC, is a licensed lender authorized by the Tribe’s Tribal Regulatory Authority.

- Loan amount: $300-$1,000

- APR: 475% – 725%

- Loan term: 1-3 months

- Credit score: Poor/Fair/Good/Excellent

See/Hide Details

Bright Star Cash

- Loan amount: $100-$1,000

- APR: 510.02% – 699.98%

- Loan term: 1-3 months

- Credit score: Poor/Fair/Good/Excellent

See/Hide Details

Cash Fairy

Clearwater Lending, LLC d/b/a/ CashFairy.com is a Tribal enterprise and economic arm, wholly owned and operated by the Ft. Belknap Indian Community (“Tribe”), a federally-recognized sovereign American Indian Tribe, and created by the Tribal Council for the benefit of the Tribe. Any Agreement entered into through this Application shall be governed by applicable Tribal and federal law.

- Loan amount: $100-$1,000

- APR: 800%

- Loan term: 1-2 months

- Credit score: Poor/Fair/Good/Excellent

See/Hide Details

Golden Valley Lending

Golden Valley Lending is owned by the Habematelol Pomo, a federally recognized tribal group of Upper Lake, California. We not only lend consumers money when they need it most, we offer the tribe a way of achieving economic self-sufficiency.

Ancestral Pomo people have occupied parts of central and Northern California for as long as history has been recorded. And today, those who have remained or returned to the ancestral tribal lands seek to conserve the land, educate their children, preserve the Pomo culture and provide economic stability to the community and people.

Golden Valley Lending Trustpilot review score

- Loan amount: $300-$1,500

- APR: 200-800%

- Loan term: 1-3 months

- Credit score: Poor/Fair/Good/Excellent

See/Hide Details

American Web Loan

- Loan amount: $300-$2,500

- APR: 480-800%

- Loan term: 0.5-1 month

- Credit score: Poor/Fair/Good/Excellent

See/Hide Details

Great Plains Lending

Great Plains Lending trustpilot review score

- Loan amount: $100-$1,000

- APR: 328.11% to 448.76%

- Loan term: 4-3 months

- Credit score: Poor/Fair/Good/Excellent

See/Hide Details

Blue Trust Loans

Cash loans up to $2,000 with Blue Trust Loans. Want to know a secret? Apply now for a Blue Trust Loan and you could get up to $2,000 by the next business day. We have exclusive special offers!

Blue Trust Loans trustpilot review score

- Loan Amount: $100 – $2,000

- APR: 471.7846% – 841.4532%

- Loan term: 1-6 months

- Credit score: Poor/Fair/Good/Excellent

See/Hide Details

Big Picture Loans

Big Picture Loans was formed by the Tribe to enhance the Tribe’s self-determination and further diversify the Tribe’s economy. Big Picture Loans is an economic arm and instrumentality of the Tribe that is organized and licensed under Tribal law and is located on the Tribe’s reservation.

Big Picture Loans trustpilot review score

- Loan Amount: $200 – $3,500

- APR: 35%† – 600%

- Loan term: 4-18 months

- Credit score: Poor/Fair/Good/Excellent

See/Hide Details

Please be advised!

The Washington State Department of Financial Institutions (DFI) has received complaints about the following online lenders:

- Island Finance, LLC d/b/a White Hills Cash

- Clear Water Lending, LLC d/b/a Cash Fairy

- West River Finance, LLC d/b/a West River Cash

- North Star Finance, LLC d/b/a Northcash

- Northern Plains Funding, LLC d/b/a Northern Plains Funding

- Riverbend Finance, LLC d/b/a Riverbend Cash

It appears that these companies may be operating as online tribal lending companies. These companies assert ownership by the Fort Belknap Indian Community, a federally recognized Indian Tribe. These companies are not licensed by DFI and are not registered to conduct business in Washington State by the Department of Licensing, the Department of Revenue or the Secretary of State.

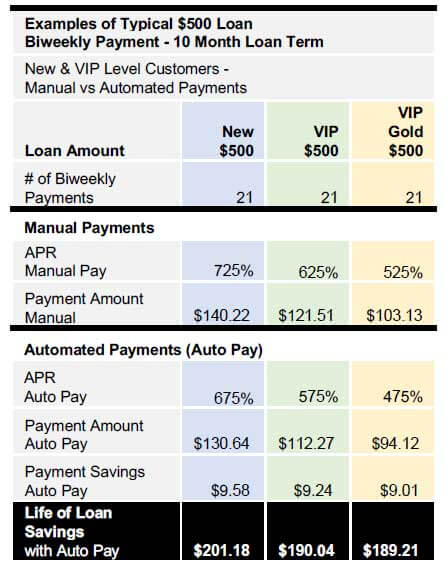

*APR = ((Total Fees/Avg. Principal Balance)/Number of Billing Cycles) * Billing Cycles per year * 100

- Total Fees = Sum of all Cash Advance fees + Sum of all fix finance changes

- Average Principal Balance = the sum of each principal balance at the end of each period divided by the number of payments

- Number of Billing Cycles = the total number of payments

- Billing Cycles per year = Biweekly/Weekly (you are paid weekly or every two weeks) = 26 and Monthly/Twice monthly (you are paid monthly or two times a month) = 24