So what is an inheritance loan? We get that question all the time. Inheritance loan really is not a loan, what it is, it’s actually a cash advance against an expected inheritance that you will be receiving.

Probate is the legal process by which assets are transferred from the deceased person to his or her heirs. This would include personal property, such as bank and retirement accounts, as well as real estate.

Table of Contents:

- Basics

- What is an inheritance loan?

- How much can be advanced?

- How long does it take?

- How much is probate loan process?

- The inheritance probate process

- Why do estates have to go through probate?

- Important things to consider about probate loans

- To apply for your Inheritance Cash Advance

- Frequently asked questions

- Am I Eligible for an Inheritance Cash Loan?

- Will My Inheritance Cash Advance Affect My Probate Timeline?

- What is Personal Liability of an Heir?

- What are Probate Cash Advances with Bank Loans?

- What are the benefits of an Inheritance Cash Advance?

- How Does the Decedent’s Will Affect Your Inheritance Cash Loan?

- How long may Heirs wait to Receive Their Inheritance?

- How Much Will My Inheritance Cash Loan Cost Me?

- Does Inheritance Cash Loan Come with No Hidden Fees or Costs?

- What Are the Requirements for a Probate Cash Advance?

- Will the Inheritance Cash Company Charge Me Fees For The Advance?

- How Do Unexpected Creditor Claims Affect My Probate Cash Advance Fees?

Basics

- What is probate?

Probate is the legal process by which assets are transferred from the deceased person to his or her heirs. This would include personal property, such as bank and retirement accounts, as well as real estate. - What is a will?

A will is the document by which a person, called a testator in the law, specifies his or her final gifts of cash or other property. The will makes the gifts, or bequests, by identifying which individuals or institutions are to receive which assets upon the settlement, or closing, of the estate. - What if there is more than one will?

The court will recognize only one will; usually, that is the last will prepared by the testator. Should there be any question about the authenticity of the will, the probate court will determine which will is to be honored. - Can a will be challenged in court?

Yes a will can be challenged in court. The primary challenges to a will include incapacity, duress, and forgery. - What is a codicil?

A codicil essentially is an amendment to a will. A typical codicil is short and deals with limited sections of the will. - What is a specific bequest?

As the term implies, a specific bequest spells out a particular gift, be it personal or real property, to a particular heir. A specific bequest of money has priority over other distributions, and will be paid first. After specific bequests have been distributed, the balance of the estate will be distributed to the heirs. - What are the repayment terms?

You receive the money from your advance now, the estate pays the advance balance at the time the estate is closed. - I have a bad credit score. Can I still receive an advance?

Your bad credit or unemployment will not, by itself, keep you from getting an advance. - The mortgage (or taxes) on the estate property is delinquent. Help!

An advance from can help you pay back taxes! An advance can provide funds to reinstate both delinquent mortgage payments and tax bills. - I’ve spoken to the estate attorney, and he said he cannot help me.

The estate attorney essentially represents the personal representative of the estate. An advance from Approved Cash Advance can help you by providing much needed funds to pay your expenses, repair or improve estate assets or simply improve your life.

What is an inheritance loan?

For example, if your are expecting to receive a fifty thousand dollar inheritance and the estate is already in probate, then what will happen, is you can actually sell a piece of that inheritance today and get some money now. Then wait for the rest of your inheritance until whenever the probate process closes.

It’s not a loan, it’s really an advance. What’s the difference there: a loan is something that you personally are going to have to pay back. Inheritance advance you personally DO NOT have to pay back, it is paid back directly from the estate itself. When the estate closes: one year or two months, whatever it may be down the road, that money is paid directly back to the investor involved. You still get to receive your portion of the estate that is remaining.

The reason it’s considered an advance is because you, as the person receiving the money, are not obligated to pay the money back. The money gets paid back from the estate itself. The investor who is involved with giving you the money, really is purchasing a portion of the estate from you and not setting up a loan relationship with you.

To sum up: inheritance loan is not a loan, it’s an advance, you’re selling a piece of your inheritance.

How much can be advanced?

Typically, for example in California, that amount is between 10,000 and 100,000 dollars. It can be more, it can be less and really the amount that can be advanced depends on the size of the expected inheritance, and that’s the only thing that typically effects it.

How long does it take?

So, how long does it take to get an inheritance loan or an inheritance advance? Typically, it takes between 3-7 days. The reason it doesn’t take very long is because, it’s really just a review of all the documents that can be provided by the attorney involved with the estate or the executor. That’s pretty much to verify that the estate exists and that there are enough assets in the estate to make sure, that the investor or whoever is providing you the advance will be able to get paid back once the estate finally does close.

In short, it really is between 3-7 days from when you contact a company to when you actually receive your money.

That again, really depends on the documents that are provided, how quickly those documents can be provided to the investor. Then just how long it takes to review those make sure everything’s in order. It’s not dependent on running extensive credit checks or employment checks. It’s all based on the estate. The money gets paid back directly from the estate, it’s not something that gets paid from you. That’s again the difference between a loan and an advance, this is an advance. The investor gets paid back out of the estate, if the estate never has any money in it, then you still don’t have to pay it back. The investor takes the risk that they will get paid back from the estate.

In California, probate is handled by the Superior Court of the county in which the deceased person lived. Probate proceedings can take at least eight months, and sometimes up to several years, to complete. Even probate cases with no unusual problems will take at least eight months, including a four-month period during which creditors can make claims. Crowded court calendars, creditor or tax claims, and will contests can all cause lengthy delays.

Claims can be filed to challenge different parts of the probate process. Claims can be filed to challenge the validity of the will, the identity of heirs, the status of the person serving as the executor and whether the executor is acting properly.

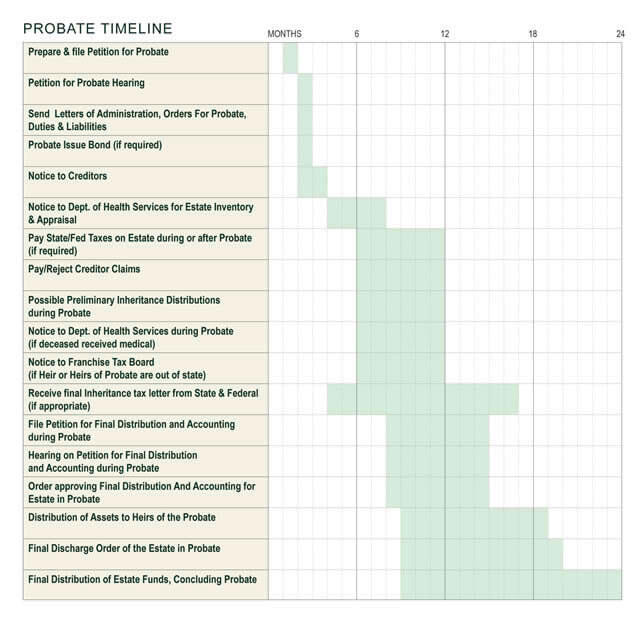

The chart below illustrates a general timeline you can expect during your probate process.

a general timeline you can expect during your probate process

How much is probate loan process?

Probate loans in California typically cost around 3-7% of the total value of the estate. The fees involved in the process are:

- Court costs

- Executor’s fees

- Surety bond

- Appraisal fees

- Legal and accounting fees

Also, keep in mind that if there is a “Will contest” expense can run even higher.

The inheritance probate process

If you are an heir to a current probate and you want a cash advance now for the money you have coming to you, you really don’t need to wait for the long drawn out probate court procedure to receive you and inheritance cash advanced.

When an heir finds out they will be receiving an inheritance, they expect to get it within a short amount of time. But that’s not usually the way the probate process works. A more accurate description of the probate process is that it’s unpredictable and the length depends on how large the dissident’s estate is, and if they left their papers in order, or left any at all. Other factors include: whether the will is contested or uncontested, tax issues or any other unforseen issues.

Appropriate process begins when someone dies. The person may have died intestate, which means ‘without a will’ or testate – ‘with a Will’. Any of the case the dissidence assets must be transferred to the person designated in the will, who is called the personal representative, executor or administrator. If the person dies without a will or the state decides the will is invalid this estate is transferred according to the state’s law. Before all their belongings are distributed all their assets must be accounted for.

Also all taxes debts and other monetary obligations must be taken care of. This can add quite a bit of time to the process. Some probate issues last well over a year if not longer. In the meantime the years waiting for the inheritance can be financially drained, even though they have money coming to them.

An inheritance cash advance can be the perfect solution to this problem. When you receive a probate advance, all you do is assign a portion of a future inheritance to an investor and they get the reimbursement from estate when the probate is closed. The process is easy to do and usually one of customer service representatives will guide you through every step of the way. There is no obligation on your part to apply.

Why do estates have to go through probate?

Any assets owned and titled in the name of the decedent at his or her death will need to be probated. Which also includes any assets which are transferred pursuant to the decedent’s last will and testament.

Do you always have to probate a will? Well, not necessarily. It depends on what the deceased owned at the time that he passed away, or she passed away, and it depends on really how they owned it. The process of probate is taking the deceased’s name off of an asset, and putting the heir’;s name on the asset. So if the deceased had a home, then more than likely we’re going to have to go through probate. If the deceased’s name is on the deed, to take the deceased’s name off the deed, and to put the deed in the name of the heir. If the deceased is married, the heir is going to be typically the spouse. Not always the spouse, but typically. If the deceased didn’t have a spouse, then it may be some other person.

It could be a charity. Taking the deceased’s name off of an item of property is what probate is all about. If the item of property doesn’t have a title, so my couch does not have a title. I don’t have to go through probate to transfer my couch to somebody because my name isn’t on the couch. My name is not on my refrigerator. My name is not on my TV. My name is on my car.

Sometimes you have to go through probate to transfer a car into the name of your heirs, and some states like California provide a very informal way to transfer automobiles from the deceased’s name into the family’s name.

Things like insurance, retirement accounts, don’t go through probate unless for some reason the estate is named as the beneficiary.

The following assets are not subject to probate:

- Joint tenancy assets

- Assets held in a trust instrument

- Big trust accounts

- Assets with a designated beneficiary

Important things to consider about probate loans

You’re probably an heir with an inheritance that’s in probate or about to go into probate. You, like hundreds of others out there, cannot wait the 12-24 months it takes for the probate process to release your inheritance. Whatever your circumstances you’re looking for a cash advance right now.

There are several things that you need to know before you apply, because there are several scams out there in California, that will take your money. For example, using the term a probate loan it’s sort of a misnomer. The term loan is not correct, because really you’re not getting loaned the money you’re getting advanced the money. It’s a buy-out of a portion of your inheritance.

Another thing you need to know that you’re not at risk. If for some reason the probate comes back and there’s another claim on it and there’s nothing left, well the advancing party cannot come after you.

To apply for your Inheritance Cash Advance

- Fill out and submit the on-site Inheritance Cash Advance application form, with basic details concerning your Inheritance as well as the dollar amount of the Probate advance you are requesting.

- In order to qualify for receiving your Probate advance, you simply need to be able to verify that you are an intended Heir of an Estate in Probate – and are duly listed as an Heir to an Inheritance of an Estate in Probate.

If you are an Heir of a Probate, you do not have to live in the same state that the deceased lived in before the Estate went into Probate. If you are a Beneficiary of a Trust or Trust Fund, you do not have to be living in the same state that the deceased lived in. - The necessary paperwork associated with your Estate in Probate – your Inheritance Cash Advance will typically be approved within 72 hours or less, once your Probate cash advance has been approved by an Inheritance Cash Advances funding officer in California.

- Usually, no sales commissions are ever taken out of your Probate cash advance.

Inheritance loans near me

Inheritance Loan Company

Inheritance Loan Company was founded to provide clients with the best loan services possible – at the lowest cost in the industry.

- No Credit or Job Check Required

- No Upfront Fees or Costs

- Funds Often Available in 24 – 48 Hours

- Advances in All 50 States

- You Don’t Pay Until the Estate Closes

Call: (415) 793-2882

www.inheritanceloan.com

Inheritance Funding Company

Waiting for your inheritance to pay out? You don’t have to! With an inheritance cash advance, you can use a portion of your inheritance right away, when you need it the most.

- Guaranteed Lowest Prices Available

- Perfect Rating with the BBB

- By far the oldest and largest company

- Operate in All 50 States

- Over 100 million dollars invested in heirs

Call: 1-800-944-2072

www.inheritancefunding.com

Approved Inheritance Cash

AIC unlocks inheritance cash for beneficiaries, heirs, trustees and administrators Nationwide. If you qualify to access cash now from an inheritance, we can fund your money in as little as five business days or less.

- To be eligible to receive your cash now from an inheritance, the following requirements must be met:

- you must be an heir or beneficiary of a will or trust;

- the estate must be in probate; and

- the heir or beneficiary must be eligible to inherit $20,000 or more.

Call: 1-877-252-6544

www.approvedinheritancecash.com

Frequently asked questions

Am I Eligible for an Inheritance Cash Loan?

If you are in line for an inheritance, then you may be eligible for a probate cash advance. Broadly, to be eligible for an inheritance cash loan, you must be named as a beneficiary of an estate that is currently in probate.

Several types of beneficiaries can also be eligible for inheritance loans. For instance, if you are a beneficiary who is due to receive distribution of an inheritance that includes lottery and casino winnings, you may be eligible for an inheritance cash loan. Beneficiaries of inheritances that include settlements as well as trust fund trustees, probate executives, administrators, estate conservators and guardians may also be eligible for a probate cash advance under certain circumstances.

Your inheritance cash loan provider will not consider your credit score or any financial troubles that you have had in the past while making a decision on your advance. For instance, if you have foreclosed on a property in the past, or have filed for bankruptcy, it may not have any kind of impact on whether you are eligible for an inheritance cash loan. That’s what makes these loans so popular, and so easy to obtain. Your current employment or financial position has no impact on your eligibility.

Additionally, you will not be held liable for any losses that the inheritance loan provider may face as a result of unknown creditors staking a claim on the estate. Unknown creditors, and legal disputes can reduce the value of your inheritance, but these are losses that the company will assume as part of its risks. However, the probate cash company will require that you be as forthcoming about all details of your inheritance as possible at the time of applying for the loan.

Will My Inheritance Cash Advance Affect My Probate Timeline?

A probate process in California can take a minimum of one year, and in some cases, can drag out for years. Typically, probate cases that are complicated, or involve multiple heirs, can drag out over a longer period of time. The longer the process is dragged out, the longer it will be before you can access your inheritance.

Sometimes, people who need an inheritance cash advance want to know if their cash loan will have any effect on the probate process. In other words, will the probate process be dragged out just because they have taken a cash advance?

The answer to that question is ‘no’. Your inheritance cash advance has nothing to do with your probate timeline. It will not delay your probate, and will not increase the length of time that you have to wait to receive your inheritance. All that the probate cash advance provider does is provide the funds necessary to tide things over until you get your inheritance, and this has no impact on your timeline.

You can use the probate cash advance to pay your daily expenses, pay off loans and mortgages, clear credit card debt, and use the money for any other kind of purpose that appeals to you. Your probate cash company will not ask the reasons for your advance at the time of payment.

The only thing that the probate cash advance company will want you to do is to be honest with all details about your inheritance. If you are aware of other creditors who may have a right on the estate, then it is important that you tell your inheritance cash loan provider. Apart from this, there are no other conditions and obligations for you to receive a cash advance.

What is Personal Liability of an Heir?

A person who has taken a conventional or traditional loan from a bank may be liable for any unpaid dues. However, no such liability generally exists when you apply for and receive an inheritance cash loan.

A person who applies for and receives an inheritance cash loan may not be liable for any damages even when there are insufficient funds in the estate to cover the advance amount after the probate has been settled. Probate cash companies find that this typically occurs when unknown creditors emerge to stake a claim on the estate. This kind of thing does happen, and it can mean that your share of the estate dwindles. In such cases, the inheritance cash company that has advanced you the money, may find that after all dues have been paid, there is no money left over to cover the cost of the cash advance that had been given to you.

These are the risks that the inheritance cash loan company will assume when advancing you the amount. You will not be held liable for any losses that the company is exposed to. However, this is only true if you have been completely honest about the presence of any creditors, or your knowledge about any claims on the estate.

That’s why it’s very important that when you apply for a loan, you supply 100% accurate information to the probate cash company. When you have provided accurate information, you will not be held liable for any losses that the company incurs once the probate has been settled.

What are Probate Cash Advances with Bank Loans?

As an heir in need of cash, an advance on your inheritance through a probate cash funding company is the only convenient option open to you while your estate in probate.

When you apply for a loan at a conventional bank, you can expect extensive formalities, and red tape. All banks will insist on a report on your credit score before they even begin to consider giving you a loan. However, an inheritance funding company will not insist on a report on your credit score before it loans you an advance. If you have declared bankruptcy in the past, or do not hold a job currently, or have other kinds of credit problems, you may not be able to get any kind of loan from a conventional bank. To an inheritance funding company however, these issues do not matter.

Additionally, a traditional loan process through your bank can take you weeks, if not more, before you get your hands on your money. There can be plenty of paperwork to complete, and any number of hoops to jump through before your bank advances you a loan. An inheritance funding company, on the other hand, can give you money within a week after your application, depending on the circumstances. There is very little formal paperwork, and the process is designed to make it easy for you to obtain a cash advance.

Besides, with a traditional bank loan, there’s always the chance that you may default on your loan, causing the bank to seize your collateral. The probate cash advance funding company takes the risk that there may be problems with your inheritance that could possibly prevent the company from retrieving the entire advance amount later on. This is just one of the risks that the company takes.

What are the benefits of an Inheritance Cash Advance?

If you have been named in a will, you can expect a gap of several months or more before you actually gain access to your inheritance. Even in a straightforward situation where the will has been properly drafted and attested, and there are few chances of unknown creditors coming forward to complicate the probate process, it typically takes at least one year or more for the probate to be completed and for the estate to be distributed. During this period of time, you may be eligible for an advance on your inheritance from an inheritance cash funding company.

Once you receive your inheritance cash advance, you can use the money for a number of purposes. Typically, probate cash funding companies find that clients use their money for day-to-day expenses. For instance, immediate expenses like rent and utilities can be met using your advance. There may also be medical bills left over from an early illness that you may be liable for. Those can be paid with your cash advance.

Other times, clients use the money to make improvements on their current real estate assets. One of the most sensible things to do with your inheritance cash advance is to pay off your mortgage. There is little that you cannot use your inheritance cash advance for, from living expenses to legal fees.

However, considering that this is an advance on your inheritance, you are advised to use your advance judiciously. The inheritance cash advance is easily available, and the funding company does not have any authority on how you choose to spend your money. Therefore, it makes sense for you to use your money sensibly to either build or strengthen your existing assets, or eliminate any existing debt.

How Does the Decedent’s Will Affect Your Inheritance Cash Loan?

Most people find out about the fact that they have an inheritance after the reading of a will prepared by the deceased. The will outlines the number of heirs, and the inheritance that is due to each of them. However in some cases, a person may die without a will. In such cases, the laws of interstate succession in California will come into play.

In cases where there is no will and the decedent was unmarried, the estate will be distributed to the decedent’s children. In case there are no surviving children, the estate will go to the grandchildren, great-grandchildren and so on.

However, if the decedent was married, the distribution of the estate will depend on whether the deceased owned community property- assets acquired during the marriage- or separate property which is the assets that are brought into the marriage at the time of the marriage. Community property of the decedent typically goes to the surviving spouse, while the separate property may be more complex to distribute. If there are no surviving kin like children, parents, brothers and sisters and others, the surviving spouse may be eligible for the separate property. If there are children, then the property may be distributed among the surviving spouse and other inheritors.

Of course, none of these rules will come into play if the decedent had drafted a will that was duly signed and attested by witnesses.

Whether the decedent died intestate or not, will have much to do with how soon you can access your inheritance. In the meantime, you can access a portion of your inheritance by applying for a probate cash advance through an inheritance cash company.

How long may Heirs wait to Receive Their Inheritance?

It’s not possible for a California probate cash loan company to provide a timeframe for the completion of an estate probate. The time-frame can depend on a number of factors, including the size of the estate, and the number of heirs involved. If the decedent did not leave his affairs in order, you can expect more complications to arise before the probate process is complete. Additionally, the process can be delayed further if the decedent failed to pay his taxes, or if the estate is mired in litigation.

Typically, a probate process must go through a number of steps. First, lawyers must file a petition for probate, and a court must set a date for the hearing. After the hearing, orders for probate must be issued. Notices must be sent to creditors and the Department of Health Services.

There must be a complete appraisal of the estate. Every estate will be subjected to estate tax and other taxes, and these taxes must be paid. Further, all creditors must be paid.

Finally, attorneys will file a petition for the final accounting and distribution of the estate. After a hearing, the court will issue an order approving the final distribution of the state. This is followed by the distribution of assets and funds to the heirs.

Although it is impossible to set an exact timeframe for the completion of the probate process, California inheritance cash companies find that many probates take at least two years to complete. It’s not unusual to have the probate of a simple estate with no debt, all papers in order and a legitimate will, to last for at least one year.

While the probate process is underway, heirs may find themselves with no access to their inheritance. If you’re willing to wait for the process to be complete, and have no immediate need of cash, then an inheritance cash loan is not for you. However, if you have an immediate need of funds, you can obtain an inheritance cash loan from a probate cash company.

How Much Will My Inheritance Cash Loan Cost Me?

One of the biggest advantages of taking a probate cash loan is that you do not have to worry about monthly installments and payments. All the costs related to your inheritance cash loan will be deducted from your estate upon completion of probate.

Your cash loan cost will be determined upfront, and you will be informed about this at the time you receive the cash loan. You can expect your cash loan to come with no hidden fees or charges.

However, it’s important to understand that your inheritance cash company takes a number of risks when it loans you cash on your inheritance. For instance, your inheritance could be reduced because of unknown creditors who come forward to stake their claim on your estate. This is one of the risks that your inheritance cash loan company will take in to account while advancing you a loan before probate. Needless to say, the presence of any unknown creditors will not make any difference to the costs of your cash loan later.

There may also be other types of claims on the estate, including tax claims. Other heirs may emerge, reducing the size of your estate further. Additionally, your probate may take a much longer time to settle than anticipated, delaying the repayment of the cash loan.

There are several risks that your inheritance cash company will take in giving you a loan without the security of a solid credit report, or any guarantees protecting the loan.

Does Inheritance Cash Loan Come with No Hidden Fees or Costs?

The one thing that you can absolutely depend on is that your inheritance cash loan or your probate cash loan will not include any hidden fees or costs that you will be surprised with after the probate ends. In fact, this lack of nasty surprises in the form of fine print is one of those factors that make inheritance cash loans attractive to so many Americans.

If you’re in line for an inheritance, and are looking for a probate cash loan, make sure that the probate cash loan company you are considering is not doing any of the following:

- Charging special documentation fees

- Charging transaction fees

- Slicing off a portion of your probate cash loan as sales commission

- Charging penalties

- Charging upfront costs before you get your hands on your loan

- Charging a processing fee or a transaction fee

Some probate cash loan companies prefer to call these expenses “processing fees,” “documentation fees” or “transaction fees.” No matter what the name, your inheritance cash loan provider should not be adding any of these hidden fees and costs to your cash loan.

A probate cash loan or an inheritance cash loan isn’t just easier to procure than a bank loan or other type of loan, but is also free of much of the fine print that you will find with other types of loans. When you apply for an inheritance cash loan and receive one, you know that the money will be returned back to the company when the estate completes probate, and not a day before. You also know that a specified amount of the cash loan will be deducted from your estate before it is disbursed to you.

What Are the Requirements for a Probate Cash Advance?

A cash advance on an inheritance is a quick and convenient way for you to receive funds while your estate is in probate. Most people that California probate cash advance companies come across are encouraged by the fact that there is no need for sureties or even guarantees, and no necessity for a good credit record for a person to be eligible for probate cash advance.

However, there are certain conditions that must be met for you to receive a cash advance.

There are requirements related to the size of your inheritance. Most cash companies require that your expected inheritance should be at least between $20,000 and $30,000 for you to be eligible for an advance.

Your estate should currently be in the probate process. However, you may be eligible for a cash advance even if the probate is at the beginning of the process.

Your probate estate must be distributed within a period of 1 to 2 years. If your inheritance is locked in a trust, even this must be distributed within 1 to 2 years, not longer.

If the inheritance is locked in a trust, then the trust must not contain any clause that specifically bans cash advances of this kind. Some trusts contain a clause called a “spendthrift provision” in trust documents. These clauses do not allow proceeds from the estate to be advanced to an inheritor before distribution is complete. Sometimes, a trust may allow advances to be paid out only on the express permission of one of the trustees.

You may be eligible for an inheritance advance on your estate even if your estate is located outside of California. However, for probate cash advance purposes, your estate must be located within the United States of America.

Will the Inheritance Cash Company Charge Me Fees For The Advance?

An inheritance cash loan is a safe, convenient and easy way to receive an advance on your inheritance. One of the most frequent questions that customers who consult an inheritance cash company for an advance on their estate is – Do you charge any fees for giving us an advance on our estate?

The answer to that question is yes. But you will not have to pay the fees to the company directly. All fees and other expenses incurred in providing you with the advance will be included in the amount that will be deducted from your estate at the time of disbursement.

While providing you with the probate cash advance, there are a number of expenses that the inheritance cash company will have to bear. For example, the cash loan provider may have to bear transaction fees. The company will also have to pay hefty legal fees to loan you money on your inheritance.

However, that doesn’t mean that you have to pay the company directly or every month. All expenses involved are deducted from your inheritance, and the company’s expenses are recovered from the probate or trust.

However, in those cases, where the probate cash advance company finds that it has been deliberately lied to, or has been provided false information in relation to the inheritance, the company may decide to take action to recover its costs. For instance, if you fail to inform the company about the existence of any other creditors, or fail to disclose any other kind of information that is directly related to the estate, the inheritance cash company may take some action to recover damages against you.

How Do Unexpected Creditor Claims Affect My Probate Cash Advance Fees?

A probate cash company takes numerous risks when it decides to give you a cash advance on your inheritance. One of the risks that a probate cash advance company takes in giving you an inheritance cash advance is the possibility that your share of your state may shrink after you have received your advance, and before it is time for the cash advance fees to be cleared. The size of your share of the state could shrink if a previously unknown creditor lays claim to the estate.

If something like this happens, there’s a possibility that there won’t be money left over after these previously unknown creditors have been paid, to cover the amount to be paid to your probate cash company. However, this doesn’t mean that you have to pay the difference.

When the estate is not able to cover the inheritance advance company’s fees for whatever reason, you will not be held accountable. If there are any losses, they are solely the responsibility of the inheritance cash advance company.

However, in some cases, the heir may have to pay back the fees of the inheritance cash advance. For instance, if the heir was aware of the presence of unknown creditors, and knew that these could possibly lay claim to the estate, diminishing their share of the estate, but failed to inform the probate cash company of this, then the person may be liable for the losses sustained by the probate cash advance company.

When you are filling out the application process, it’s important to be honest and forthright about all estate-related information you are aware of. If you know of any other creditors who may lay claim to the estate, or any other reason why your share of the estate may dwindle, make it clear to your probate cash advance company right at the outset.

Los Angeles, Oakland, San Bernardino, Riverside, San Diego, San Jose, San Francisco, Sacramento, Fresno, Stockton, Modesto, Bakersfield, Anaheim, Santa Ana, Long Beach, Ventura, Salinas, Vista, Palmdale, Palm Springs