Shop for personal loans on-line!

Get the hottest internet deals on personal loans from a huge selection of Australia’s leading financiers.

Click here for a quote

If you’re looking for opportunities for bad credit loans for unemlployed in Australia, your best bet is to apply in the country’s metropolitan areas. While this can be done elsewhere, it may be more difficult to find a lender to trust you outside the key cities.

Of course, being able to apply for a jobless people loan is always possible, but getting a guaranteed approval is a different matter. And to increase your chances of getting that yes, it will be wise to prepare with a considerable understanding of how the system works.

Table of Contents:

- Payday loans to Fix Your Short Term Needs

- Things You Must Know About Loans For People on Centrelink

- Payday loans direct lender Australia

- Payday Loan Alternatives for people with low income

- Emergency relief for unemployed in Australia

- How to deal with debts and bills for unemployed person

- Loan companies you should not deal with

- Unemployment Rate in Australia 2018

- Bad credit Home Loan in Australia

If you are not having any regular income source, then you can be in serious trouble. The trouble, of course, is your inability to tackle your day to day needs. When you are unemployed, it becomes almost an uphill task to tackle your day to day expenses.

Moreover, the lenders are not forthcoming, when it comes to availing loans. But then, on relying upon the provision of instant cash loans, you do have a chance to acquire the funds needed, so as to deal with the looming crisis. Moreover, the loans do get approved guaranteed without any further delay, which then lets you resolve the crisis, without much of a hassle.

Unlike regular loan options, where to avail the funds, you are required to undergo a lot of complex formalities, there is no such need with instant cash loans or payday loans. For instance, there is no need to produce any asset as collateral, which then makes it convenient for you to attain the funds. Moreover, the lenders do not show any particular interest in knowing your credit profile. Of course this is beneficial; as it lets you extract the funds, even when your credit score is not really up to the accepted norms.

You do need to be a citizen of Australia and that your age should be more than 18 years. Having a valid checking account is also necessary, so that the amount released can be deposited. As for the amount made available, you can derive funds maximum of up to AU$3,000. The repayment terms are very flexible and span over a period up to 2-4 weeks, i.e. until you get a suitable job.

Even before going for payday loans, a detailed and proper research will help you get access to lucrative terms and conditions. Moreover, applying online is simple and offers you the chance to obtain the funds in less than 48 hours. By applying online, you will not anymore be required to fax the documents or fill up lengthy application form, which then saves you a great deal of time.

Loans for unemployed in Australia can be attained with relative ease to resolve short term unforeseen expenses, without worrying about constraints.

Payday loans to Fix Your Short Term Needs

Unemployed individuals do have a tough time, especially while confronting unforeseen financial crisis. The fact that the applicant does not have any regular income source makes it difficult for the applicants to obtain the funds. Even under these circumstances, it does not entirely mean that the applicants can no way avail the funds. In fact, to help out these applicants, the lenders have now come up with the provision of fast cash loans for unemployed.

These loans are crafted such that it only caters to those, who are unemployed as well as to those, who have lost their source of income recently. Once the funds are available, it can be used to deal with the various short term needs and demands. Besides, the payday lenders do not make any obligations, as to how and where the loan amount is being used.

In context of these loans, the applicant gets to receive the funds, without the need of involving any collateral. In addition to these, there is no such need to undergo any credit check. This in turn clearly implies that applicants having serious credit disputes on how to use these loans.

The amount derived then has to be repaid over a period of 2-4 weeks, which do seem conducive enough. While the rate of interest levied on the payday loans can be marginally high, viable terms can be procured by undertaking a detailed and proper research.

To avail these emergency cash loans for unemployed with no more hassle, the best you can do is to make use of the online application. Online application does not require any documentation. The applicant just needs to fill in the personal details. Upon verification and approval, the loan amount is then immediately made available.

Loans for unemployed does provide the applicants a chance to acquire immediate funds, which then can be used to deal with any sudden or unforeseen financial urgencies.

Do you Really Need to Borrow?

Emergency loans for unemployed such as those offered by Australian Payday lenders can be useful in your time of need, but can be expensive.

Always check your options before you borrow:

- For information about other options for managing bills and debts, ring 1800 007 007 from anywhere in Australia to talk to a free and independent financial counsellor.

- Talk to your electricity, gas, phone or water provider to see if you can work out a payment plan.

- If you are on government benefits, ask if you can receive instant cash loans on Centrelink, Call: 13 17 94

- The Government’s MoneySmart website shows you how short term loans for unemployed work and suggests other options that may help you.

* This statement is an Australian Government requirement under the National Consumer Credit Protection Act 2009. Cash Direct Pty Ltd – Australian credit licence number 393862.

Centerlink Australia

Things You Must Know About Loans For People on Centrelink

Centrelink is a part of the numerous programs offered by the Department of Human Services in Australia. The aim of this program is to offer services and monetary assistance to people like retirees, physically challenged individuals, parents and guardians and to those who are unemployed. If you are receiving the benefits through this program, you must know the procedure to obtain personal loans for centrelink recipients to meet your emergency or important requirements.

Instant cash loans on Centrelink are offered by banks, credit unions as well as other organizations. Here are few things you need to know before applying for these loans.

Who Can Apply?

Any individual receiving benefits from Centrelink may find them inadequate to meet the requirements like buying a car, emergency house repair and unavoidable medical treatment among others. Any individual on Centrelink can apply for these instant loans to obtain funds. Even those with poor or bad credit score can apply for instant cash loans on Centrelink.

Where to Apply?

The best way to obtain this type of loan is through internet. You can search for lenders offering these loans and compare their offers to find the best one. The benefit of obtaining these loans online is that it is a fast process. You may find the loan amount directly deposited to your bank account within few hours.

Types of Loans

Loans for people on Centrelink are mostly of unsecured types. This is because those applying for these loans usually don’t have collateral or security against which secured loans can be obtained. Payday loans Centrelink no credit check are also available. Among the most popular options is the personal loan for Centrelink people. Have a look at the amount being offered and the interest rate being charged.

Choosing the Right Lender

It is worth mentioning that loans for people on Centrelink are available on higher interest rates than other types of loans. Still, you can look for lenders offering these loans at decent rates. Banks usually charge decent interest rate, but their process of approving these loans is quite frustrating. On the other hands, private lending companies offer these loans on higher interest. However, there are some organizations that follow a middle road and offer decent Centrelink loan deals with fast and guaranteed approval.

Before you choose a lender for payday loans for people on Centrelink, you must evaluate the deal on the basis of interest rate and approval process. Refer to the reviews and recommendations on the internet to move in the right direction.

Payday loans direct lender Australia

Often, people confuse brokers with direct lenders. A broker offers the loan products of various lenders, while a direct lender provides the actual loan money to the borrower. Essentially, a broker is a loan provider who serves as a liaison between borrowers and lenders.

A broker can work within a firm or independently. A broker doesn’t loan money. Instead, he or she works with borrowers, supplementary them in finding suitably matched personal loans. Typically, a broker will learn the needs of the borrower and do the work of shopping for the best loan deal from lenders offering that particular type of loan. Brokers frequently work with numerous lenders; attempt to match the right lender with each individual client. Some brokers actually have hundreds of lender contacts. Because they have so many lenders from which to choose, brokers are more likely to find loans for borrowers with exceptional needs, like problem credit, than individual direct lenders.

Brokers accept applications from borrowers and hunt to lock in rates and terms with lenders. They also provide required state and federal disclosures. In addition, brokers gather all necessary documents, including, but not limited to, credit reports, employment verifications, asset disclosures, and property appraisals. Once an application file is deemed complete, the broker submits it to the appropriate lender, who then handles loan approval and disbursement.

Loans for unemployed in Australia

Regularly, a broker will provide basic credit counselling in an attempt to assist borrowers with correct credit issues. He or she may also advise borrowers on ways to obtain better loan rates. Brokers answer questions and assist borrowers in understanding both the application process and loan details as well. The broker only offers assistance before the loan process is complete. Once the borrower has obtained a loan, the broker is effectively out of the loop and all questions must be asked of the direct lender.

Brokers earn commissions in exchange for bringing borrowers and lenders together. Usually, the broker’s commission is paid indirectly by the buyer, in the form of closing costs or additional loan points. The broker receives payment when the loan is closed.

Brokers have been active in Australia since the early 1980s however they have only become a governing force in the mortgage industry during the late 1990s on the back of aggressive marketing by Aussie Home Loans & Wizard Home Loans. Approximately 35% of all loans held by a mortgage in Australia are introduced by brokers.

Brokers are now regulated by the Australian Securities and Investments Commission. The new national consumer credit protection legislation includes a licensing regime and responsible lending obligations. Brokers are also required to be a member of an external dispute resolution provider such as the Credit Ombudsman Service Limited (COSL). Further, some lenders require accredited brokers to be a member of an industry body such as the Mortgage & Finance Association of Australia (MFAA).

Australian brokers do not usually charge a fee for their services as they are paid by the lenders for introducing loans. They are paid a direct commission that is on average 0.66% of the loan amount and an ongoing trail commission that is on average 0.18% of the loan amount per annum paid monthly. These commissions can vary significantly between different direct lenders and loan products, especially since the commission re-alignments introduced by Australian banks during June to August 2008 in reaction to the Subprime mortgage crisis.

Although brokers are paid commissions by the lenders this does not alter the final rate or fees paid by the customer as it may in other countries. Brokers do not have the ability to charge the customer a higher or lower rate and in return obtain a higher or lower commission. The majority of brokers are regulated to ensure compliance with banking and or finance laws in the jurisdiction of the consumer; however, the extent of the regulation depends on the jurisdiction.

Payday Loan Alternatives for people with low income

Getting a no or low interest loan for unemployed in Australia

1. Low Interest Loans

StepUP is a low interest loan for people on low incomes who have difficulty accessing credit from a bank. It works great as a Payday loan alternative. You can borrow from $800 – $3,000 with up to three years to pay it back. There are no fees. Microfinance workers will help you to collect the documents you need, complete the application and help make sure that you can afford to repay your loan. Loans can be held in individual or joint names. These loans are to help people to improve their quality of life and are provided on a not-for-profit basis.

- Safe and affordable $800 – $3,000 loan.

- No fees and low interest at 5.99% p.a. (Comparison rate* 5.99% p.a.)

- Repay over a set term of up to 3 years.

Download the StepUP Loan brochure (PDF, 525kb)

To qualify you must:

- Have a Health Care Card/Pension Card, or receive Family Tax Benefit A

- Reside in your current premises for more than 3 months

If you need urgent help with money, don’t be afraid to ask for help. There are services and support available that can help you get through difficult times.

2. No Interest Loans Scheme

The No Interest Loans Scheme (NILS®) provides people on low incomes access to safe, fair and affordable access to credit. The scheme offers loans between $300 – $1,200 for essential goods and services. Loans are not for cash. Repayments are set up over 12 – 18 months. There are no interest charges or fees.

Good Money is a community finance hub operating in Queensland, South Australia and Victoria which helps people manage their money and access no interest or low interest loans (such as NILS) to purchase household goods. The service also provides tips about buying energy-efficient products and getting the best price on goods through a buying service. Good Money is not-for-profit and does not charge fees.

- Loans of between $300 – $1,200 for essential goods and services such as fridges, washing machines or education expenses

- Simple car and contents insurance with flexible payment options.

- Free and confidential financial counselling services for anyone experiencing financial difficulty.

Good Money offers small loans for unemployed in Australia for the things you really need.

How does it work?

- Enquire about a small loan by either dropping in, calling your nearest store, or filling out an online enquiry form.

- Supply your paperwork to your local store at a face-to-face meeting.

- Your loan application is assessed.

- You are informed of the outcome of your loan application and agree to repayment terms.

The No Interest Loan Scheme (NILS) is run by Good Shepherd Microfinance and provides individuals and families on low incomes with safe, fair and affordable credit.

Loan amounts can be $300 – $1200 for essential goods and services. Once your application is approved, repayments are set up at an affordable amount for 12 to 18 months. The goods and services the loans help cover may include but are not limited to:

- household items such as refrigerators, washing machines, stoves, dryers, freezers and some furniture

- some medical and dental services

- educational essentials such as computers and text books.

Participants make regular deposits towards a savings goal over a 10-month period and attend workshops to build their financial management skills. When participants reach their savings goal, ANZ matches the amount – up to $500 – towards education costs including uniforms, text books, laptops, sports equipment, music tuition, TAFE or apprenticeship costs, and much more.

Who is eligible? To qualify for NILS you must:

- have a Health Care Card/Pension Card

- reside in your current premises for more than three months

- show a willingness and capacity to repay the loan.

You can use NILS to buy:

- essential household items such as whitegoods (like fridges and washing machines), computers or furniture

- health items such as wheelchairs or asthma pumps

- to pay for car repairs (although these loans are only available to people who live in areas where there is little or no public transport)

NILS providers are based in community centres and other local organisations across Australia. To be eligible for NILS, you must have a Centrelink healthcare or pension card (or qualify for one). You must also show that you can and are willing to repay the loan within 12 or 18 months.

To find your nearest NILS provider, visit the Good Shepherd Microfinance website or call 13 64 57.

No Interest Loan Scheme: How it works

In this video you can find all you need to know about the NILS loans, Step Up Loans and the dangers of “Payday” lenders.

3. Matched savings programs

Saver Plus helps families on low incomes develop a savings habit, build assets and improve their financial skills. You set a savings goal and receive support and education to help you achieve it. When you reach your goal, your savings are matched, dollar for dollar, up to $500.

- up to $500 in matched savings for education costs

- fun, free and informal financial education workshops

- assistance and support from a Saver Plus coordinator to establish a savings goal and develop a savings habit.

Participants make regular deposits towards a savings goal over a 10-month period and attend workshops to build their financial management skills. When participants reach their savings goal, ANZ matches the amount – up to $500 – towards education costs including uniforms, text books, laptops, sports equipment, music tuition, TAFE or apprenticeship costs, and much more.

How is eligible?

You may be eligible to join Saver Plus if you:

- have a Centrelink Health Care Card or Pensioner Concession Card

- are at least 18 years old

- have some regular income from work (you or your partner) including casual, part-time, full-time or seasonal employment

- have a child at school or attend vocational education yourself.

Emergency cash for unemployed in Australia

If you urgently need help with living expenses there are charities and community organisations that can help you with:

- One-off food, transport or chemist vouchers

- Rent or accommodation

- Part-payment of electricity, gas or water bills

- Food parcels or clothing

- Budgeting or referrals to other programs

Here is how to find your nearest emergency cash relief service:

- Search for emergency cash relief providers in your area using the Department of Social Services Grants Service Directory. Within the directory, search for ‘Financial Crisis and Material Aid – Emergency Relief’.

- See the directories on the Salvation Army website or call their national number on 13 72 58, or see the St Vincent de Paul website or call 13 18 12.

- Contact your local church, community centre or community organisation and find out where emergency relief is provided in your area.

If some of your financial problems are due to another person running up debts in your name, or pressuring you to spend money or sign up for a loan for unemployed, you may be experiencing financial abuse. Visit the financial abuse webpage for a list of organisations that can help.

How to deal with debts and bills for unemployed person

Talk to your creditors

Start by contacting your bank, utility or phone provider and let them know you’re experiencing hardship. Talk to them about adjusting your loan or bill repayments to a more manageable level. Here are some tips on how to start talking to your credit providers.

If you’re finding it hard to pay your phone or internet bill, see the Australian Communications Consumer Action Network’s information on staying connected when things get tough.

See a financial counsellor

Financial counsellors give advice on credit and debt issues and can help you negotiate with your creditors. They work in community organisations and their services are free, independent and confidential.

They have a Debt Self Help Online Assessment Tool you can use to start assessing your debts.

Here’s how you can find a financial counsellor in your local area.

Smart tip

Some charities provide vouchers to assist with electricity debts. Contact your local community organisation to find out more.

Don’t rush into anything

You may be tempted by quick fix solutions to your problems such as:

- Taking on a pay day loan

- Increasing your limit on your credit card

- Signing up to a debt agreement

- Getting a rent to buy deal

- Consolidating your loans

- Going bankrupt

Before signing up to any of these talk to a financial counsellor. They can clearly explain your options.

Loan companies you should not deal with

List of unlicensed loan companies by ASIC

If you have received a call or email from someone you don’t know offering you a great investment opportunity or a loan, be very wary. The caller may be a scammer trying to take your money. Scams come from companies operating overseas and in Australia. Australians lose millions of dollars every year to scams and you do not want to be the next victim.

Protect yourself by checking this list of companies and individuals that are not licensed by ASIC. If the company that called you is on this list, do not deal with them.

-> Download the list of companies you should not deal with

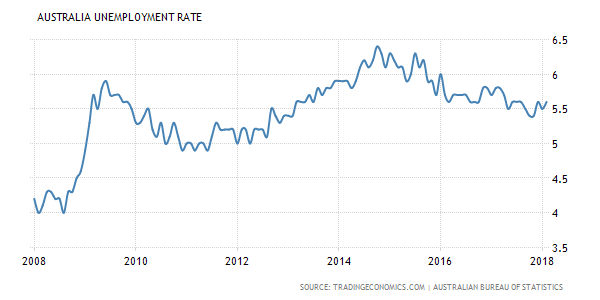

Unemployment Rate in Australia 2018

Australia’s seasonally adjusted unemployment rate fell slightly to 5.5 percent in January of 2018 from an upwardly revised 5.6 percent in the preceding month and in line with market consensus. The economy added 16,000 jobs while the number of unemployed declined by 7,900. Unemployment Rate in Australia averaged 6.88 percent from 1978 until 2018, reaching an all time high of 11.20 percent in December of 1992 and a record low of 4 percent in February of 2008.

Unemployment Rate in Australia 2018

Bad credit Home Loan in Australia

The Role of Your Credit Rating

The term, credit rating, can be intimidating to someone who has a poor one and has no job. The good news is this number isn’t the absolute indicator of your chances of success as a borrower. For example, if you’re applying for a home mortgage refinance loan, you may actually get a guaranteed approval even with a low credit score if you have the money to make a sizable down payment (around 20% of the purchase price if you’re a first time home buyer applying with bad credit.) That means if you were planning on a $400,000 property, your down payment must not go below $80,000. Even so, if you get very lucky, you may not need that much money as long as you can show to the lender that you are working to improve your credit.

Credit Score Improvement

You have bad credit alright, and improving that score can result in a reduction of interest rates charged by your lender. But how exactly do you improve your credit score so you can take a shot at those bad credit home loans? This can be as simple as paying off your existing debts, perhaps through a personal loan or a consolidation loan where all of your debts will be collected as one. Additionally, you can start paying off those balances straight from your own pocket. In any case, remember that in Australia, one of the best ways to raise your chances of getting a home loan with bad debt is finding a co-signor. This person will serve as your guarantor who will be held liable by your lender, in case you are unable to pay off the loan.

Knowing Your Own Financial Status

As mentioned earlier, it’s not just your credit score that matters to lenders when you apply for a new home mortgage or a home mortgage refinance loan with bad credit. You should also demonstrate substantial knowledge about your current financial status. That means being able to talk to them about your credit score and what led you there. Of course, aside from helping to earn the trust of creditors, knowledge of your own financial situation will help you strengthen your application and determine what terms may be reasonably expected. When you apply online, you will find that the process can be very simple. More than that, knowing how you are financially situated will help you identify parts of your application that need emphasis and those that can use a bit of playing down.

What to do Next?

Still have no idea what steps to make? We have collected the publications related to managing your money, borrowing and credit:

- What is a debt and where to get help?

- Protect yourself from scams

- Credit, loans and debt

- Dealing with debt collectors

- Do you need urgent help with money?

- Problems paying your mortgage?

- Helping people in financial difficulty

- Can’t pay your debts

- Interest-free deals

- No or low-interest loans

I’m in URGENT need of $2500 will repay over 3 weeks can come to an agreement!?

Please contact me.

[email protected]