Today, we’d like to share with you how to get the most of a hard money loan.

Real estate is a long term finance and management proposition. You’ve got to get good at management, if you’re going to be successful. Also, equally as important, you’ve got to secure a solid source of financing. Less money down equals more deals, more equity, more net worth, more cashflow all of those good things.

Now let’s examine a deal. Let’s pretend that we bought this deal right here, this is our house that we found.

We’re buying it for 55,000 dollars at a discount. It’s going to cost us 20,000 dollars to fix up this house, because it’s a distressed home. And because we’re putting the sweat equity in it, it’s actually going to be worth one 100,000 dollars ARV (after repair value). What that means is, when we sell this house, or when we retain it as a landlord, it’s going to have 25,000 dollars in equity, minus whatever closing costs are initially when you buy it.

What are Financing Options?

There are different ways you can finance this and let’s examine some of those different techniques.

Bank financing

The first thing we think of, when we think financing, is we think bank financing. That’s where we go to to get money. That’s what our parents did. That’s what our brothers and sisters do when they get real estate loans. And that’s the first place that a real estate investor looks when their new.

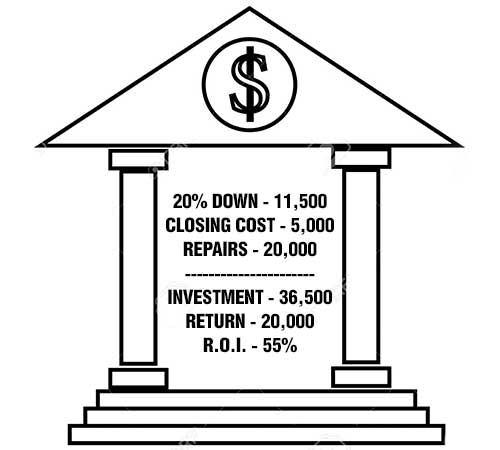

Here’s a bank financing works. They’re going to make you come with a 20% down payment. And that’s based off of the either the appraised value of the home, or the purchase price whatever happens to be lower. So, they’re not actually giving you any advantage for buying a distressed property.

20% down, we know is 11,500 dollars because we’re buying it for 55,000. They’re going to make you pay the closing cost. They’re not going to roll that into the loan and fortunately, but that’s going to be roughly 5,000 dollars for your title and all your underwriting fees, and all those things associated.

They’re not going to lend you money for repairs, banks don’t do that. You’re going to have to come up with that out of pocket. You have to pay the general contractor 20,000 dollars. Basically, you add all those things up in a out of your pocket investment on that deal, if you’re going to buy it, it is 36,500 dollars. That’s your investment into the real estate transaction the bank finances the rest.

Your return when you’re going to sell that is 25,000 dollars minus closing costs. So, that’s 20,000 dollars.

We made 55% on our money.

Well when you look at financing, the best thing you can do is you need to look at it in terms of ROI (return on investment). All we do is we divide 20,000 into 36,000 to determine what that is. We put 36,500 into this investment. We got our initial investment back and we made 20,000 dollars.

So, what did we make is 55% on our money.

Pros and cons of bank financing

Here’s some other advantages and disadvantages of bank financing, if you do go to a bank. You’re going to get a low interest rate, very very low. You’re going to get a long term. You don’t have to worry about paying this loan back right away. You can get a 30 year fixed term with most banks.

Bank financing advantages:

- Low interest rate

- Long term

Here’s one of the bad parts: Banks require an inspection. If this property is 20,000 dollars in repairs and it doesn’t pass inspection, they’re not going to finance it until those repairs are done. You may have to go back to the seller and try to get them to do that. And if you’re buying it as a foreclosure, it’s just not going to happen. So that financing is going to work in that scenario.

Here’s one of the big parts too: Banks don’t allow double closes or assignments. At least 50% of the good deals that come into your e-mail box that you find out there are from wholesalers or flippers. And they double close or assign the property to you. You’re limited to 50% of the houses that are OK for this financing.

But one of the biggest disadvantages of using bank financing is: There’s a 30-60 day period in order to close that loan. And when you’re buying these properties from motivated sellers, from banks that want to get the assets off their books, they’re not going to be too excited about you taking 30-60 days to finance this property. Because potentially you could burn up all that time and the financing could fall out. They’re going to want to go with a cash buyer or somebody that uses a different type of financing that can close in 5-10 days. That’s more secure for them and they’ll probably take a lower offer in order to have that assurance that it’s going to close.

Bank financing disadvantages:

- Requires inspection

- No Double Close or Assignments

- 30-60 days to close

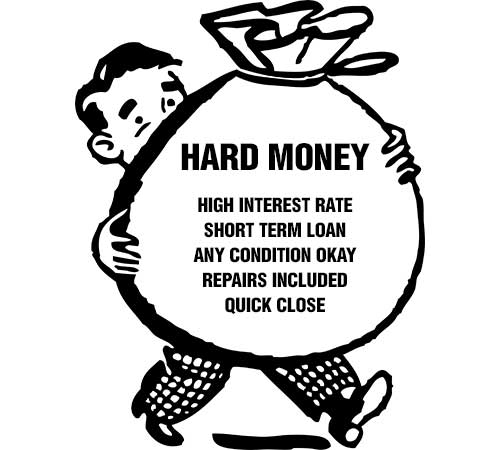

What is a hard money loan?

Another type of financing you can use is called hard money loan. It’s also called Rehab loans, it’s also called bridge loans, all those things. But at the end of the day what it is, it’s money that comes from a private source, specifically for real estate investors.

One of the disadvantages of this is it’s got a high interest rate. Another disadvantage is a short term loan. Unfortunately, you can’t have your cake and eat it too. The reason it’s a high interest rate is because it’s a short term loan. They know that you’re going to have this money back to them within 90 days or something like that. So they’re going to need to make more money on the transaction versus a thirty year loan.

Hard money loan financing disadvantages:

- High interest rate

- Short term

One of the very nice things about it is any condition is OK. They know you’re going to buy a distressed property. So they’re OK with the house that needs a lot of work. The other nice thing is the repairs. They’re actually going to be included in the loan, you’re not going to have to come out of pocket fully for those repairs. But the biggest advantages, they’re going to be able to close that deal in as little as 5 days.

When you make that offer, it’s going to be a very strong offer. And chances are you’re going to get that contract versus the other people that have bank financing.

Hard money loan financing advantages:

- Any condition okay

- Repairs included

- Quick close

Hard money financing works a little bit different than bank financing. It’s actually more concurrent with an investment property versus a home that you’re going to live in.

What is a hard money lender?

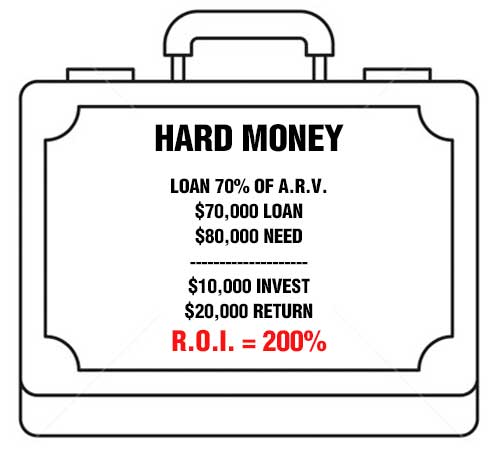

The way hard money lenders work is, they lend you approximately 70% of the after repair value. It doesn’t have anything to do with the purchase price. The nice part about that is the lower you’re buying the property for, the bigger discount you’re getting, the less money you’re going to come to closing.

We’re going to lend 70% of the after repair value ARV. And remember that was 100,000, so the loan is actually going to be 70,000 dollars. And let’s look at what you need on this deal. You need 55,000 to buy it you need 20,000 dollars to repair it and you need 5,000 dollars for closing cost.

Well we’re going to roll that all together and that’s 80,000 dollars is what you need to do this deal. You’re going to get a 70,000 dollar loan, you just come with a difference. Your total investment, your total downpayment that you come closing with is only 10,000 dollars on this transaction. Your return is going to be the same – $20,000. Roughly, you know you’re going to spend a couple extra hundred dollars in interest payments over the course of the 3 months. So, your ROI return on investment in this scenario is 200%. Much better than 55%.

We made 200% on our money.

This is why investors choose to use this type of financing irregardless of the higher interest rate or the shorter term of the loan.

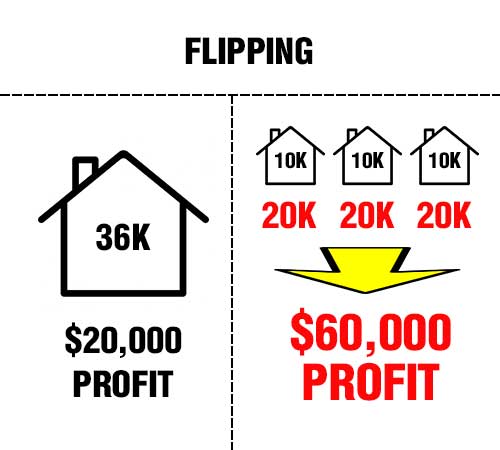

Flipping with Hard Money Loan

Less money down equals more deals, more net worth, more cash flow, more profit.

If you’re a flipper, the advantages are really going to come become apparent. If you look at it with not just ROI, but actual money in your pocket. If you’re flipping and you buy one house with bank financing. And it takes 36,000 dollars to get the deal done out of your pocket and you make 20,000 dollars in profit. You can do three of those houses with a hard money loan for less than 36,000 dollars. 10,000 a piece and you can make 20,000 on each one of those and that’s a 60,000 dollars profit.

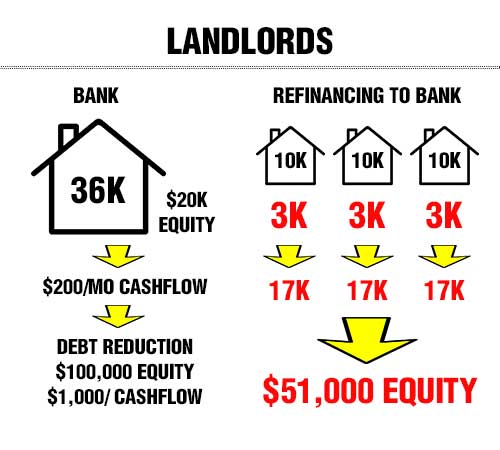

Landlord with hard money loan

If you’re a landlord this principle is more true than in any other type of investment. If you’re buying from the bank, you’re going to spend the same amount. 36,000 dollars down. You’re going to have 200 dollars a month in cash flow and 20,000dollars in equity. Why won’t you buy three of those houses and get that equity captures 3 times 10,000 dollars down on each one of them. Less money out of pocket again.

And what you’re going to do with the hard money loan with that high interest rate, you’re just simply going to do a rate and term refinance. Up to 75% of the new appraised value of the property. Keep in mind the repairs are done and this property looks great now. Bank financing will work now, once you’ve fixed it up.

There’s going to be a cost to refinance it’s going to be about 2,000-3,000 dollars per property. You’re not going to have to come with that out of pocket, but you’re going to roll it in your loan. It is going to reduce the equity you have in the property down to 17,000 dollars from twenty. But you have three of them now, so your equity is much higher: 51,000 dollars versus twenty.

Debt reduction is a very big piece of being a landlord and this is the long term part of real estate. Debt reduction is basically when it pays off your mortgage for you over time. If you used bank financing initially, and you were only able to buy one of these houses. After it was paid off you’d have 100,000 dollars in equity, and your cash flow would go up to 1,000 dollars a month.

Where you get the most bang for the buck. Less money down allows you to buy three properties and refinance them. And the debt reduction on three properties would give you a 300,000 dollar equity spread or net worth in those properties. In addition to that you would have three times the amount of the appreciation. And you’d have three times of the cash flow in these deals, so your capital would actually be 3,000 dollars versus a 1,000.

Remember, less money down equals more deals, which equals more equity, more income, more appreciation and a much higher net worth!